The concept of this scope item is to help speeding the revenue recognition process in SAP S/4HANA Public Cloud.

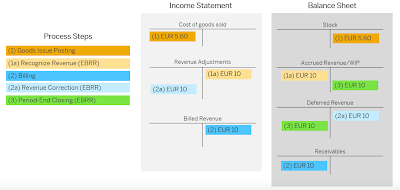

The classic problem is that the revenue is not always recognised at the same time as COGS as the COGS is posted during Goods Issue to customer and then the revenue will be posted during the billing.

With this new feature of Event Based Revenue Recognition – Sell from Stock, system automatically posted the revenue adjustment at the time of Goods Issue (depends on the EBRR Key that you have selected but in this example, I will focus on the Revenue Recognition Key – SFS.

Below is the concept of EBRR posting (1a) and (2a) automatically by system.

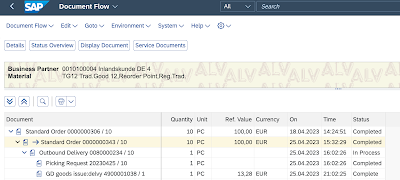

Below are the details in the system.

The following parameters are defined for sell from stock process:

◉ Material cost: EUR 13.28 per piece

◉ Price: EUR 10 per piece

◉ Ordered quantity: 10 PC

Step 1: Partial Delivered quantity: Goods Issue of 1 PC – No billing yet.

Delivery of 1 PC

At this point, the EBRR is triggered to posted the revenue of 1 PC.

Here is what it looks like in Sales Order Actual Report – Revenue Adjustment and WIP Acc Revenue posted of 10 EUR.

Sales Order Actual Report – 1 PC Delivered

Step 2: Delivery the rest of the qty 9 PC of this sales order. No billing yet.

Here is what it looks like in Sales Order Actual Report – Revenue Adjustment and WIP Acc Revenue posted of 100 EUR (Sell Price 10 EUR x 10 PC).

EBRR Posting for 10 PC

Step 3: Create Billing. After we have released billing to Accounting, the Revenue Adjustment and the WIP Accrued Revenue should be cleared out.

Billing created for 10 PC

Sales Order – Actual App showing the Real Revenue Domestic posting (in Blue). The WIP Rev Cleared out and Rev Adj cleared out (in yellow).

EBRR Cleared out – Real Revenue Posted.

At month end, Run Revenue Recognition – Sales Order app and here, the WIP Deferred Revenue should be netting with WIP Accrued Revenue account for this sales order.

Job Output – the WIP Rev is netting out

Now check the Sales Order Actual Report again and it is cleared out.

No comments:

Post a Comment