For sure you have already heard about the SAP S/4HANA Accruals Management?

Starting with S4 HANA OP 2021, the Accrual Management provides a new functionality to process deferrals. So far, the processing of prepayments is a typical and manual activity for the Finance users. With this new functionality Finance can achieve efficiency gains and it’s quite easy to implement as well. And you can also use the deferrals’ part even if you didn’t implement the accruals’ part yet.

In this blog I will show you how to set up the SAP S/4HANA Accruals Management for deferrals in order to optimize this process.

Configuration Steps:The customizing for the deferrals is actually not very cumbersome.

You can access the Accruals Management customizing over transaction code “ACEIMG”.

At first, we have to do the basic customizing in the section “Basic Settings” where we define for example which Company Codes are relevant or which Accrual Item Types should be defined.

The Accrual Item Types delivered in Standard should already be quite helpful.

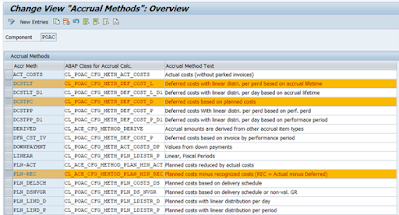

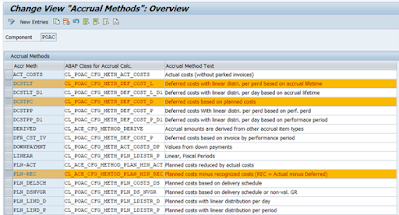

Same is valid for the Accrual Methods that are defined in the section “Accrual Calculation”:

Figure 1: Customizing of the Accruals Management

In our case we use the Standard Accrual Method “PLN-REC” to calculate the deferrals.

For the recognized costs we use “DCSTLT” for linear cases based on the Purchase Order life time (i.e. for rent prepayments where we pay one year in advance, every month the same amount) and “DCSTPC” for cases based on the delivery schedule (i.e. prepayment for engineering services for materials that are based on a certain delivery schedule):

Figure 2: Customizing Accrual Methods

You can also create custom Accrual Methods, but then coding experience is required.

If really required, the section “Review and Approval of Accruals” could also be customized. But in our case where we only post deferrals this might make less sense as within the review the amounts should not be changed. Instead the correctness of the Purchasing Documents should be ensured, we will see this later in this blog.

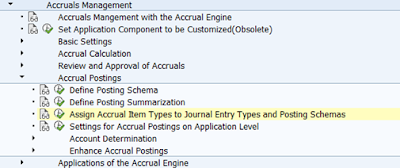

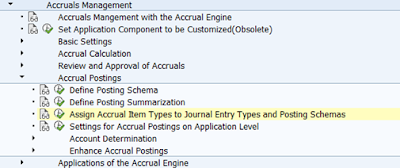

As mentioned in our case we would like to use the Accruals Management only for deferrals postings. If so, the only thing we have to do is to ensure that only the Accrual Item Types relevant for deferrals generate postings.

This can be defined in the section “Accrual Postings”:

Figure 3: Customizing of Accrual Postings

Here, we can define a Posting Scheme for the relevant Accrual Item Types, means only assign accounts to the respective Transaction Type / Posting Scheme.

In our case for deferrals without accruals, only the invoice postings / opening postings and the periodic postings are relevant:

Figure 4: Customizing of Posting Schema

As last step the we need to define the Purchase Order Transfer into the Accruals Engine as we would like the Accruals Objects to be created and calculated automatically out of the Purchase Orders.

This customizing you find in the section “Purchase Order Accruals”.

We define a Purchase Order Transfer Variant and assign a Company Code to it:

Figure 5: Assignment of PO Transfer Variant to a Company Code

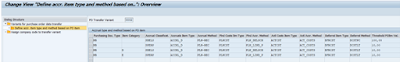

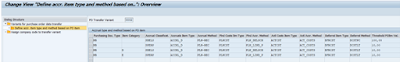

And then we define the calculation methods to be used, means which Accrual Item Types and which Accrual Methods to be used for this Transfer Variant:

Figure 6: Customizing of PO Transfer Variant

This is actually a quite important activity in the whole setup as here we need to check which use cases are required, how they are set up as a Purchasing Document and which different Accrual Methods these use cases require.

In our example use cases above, for rent prepayments we would use the Method “DCSTLT” for linear distribution and prepayment for engineering services for materials the Accrual Method “DCSTPC” for a distribution based on delivery schedule would be used.

As we require different Accrual Methods, we need to be able to also distinguish the relevant Purchase Orders accordingly. For this we 3 criteria’s available: the Purchasing Document Type, the Item Category and the Accruals Classification.

This means in our example that the Purchase Orders for rents need to have either a different Item Category or Accruals Classification as the Purchasing Document Type is the same as for engineering services. In our case we went for a different Accruals Classification (“SPERP” and not “SDELS”) which is triggered by the Product Type Group in the Purchase Order. This Product Type Group has the value “2” for rents and is then classified as a service and receives the Accruals Classification (“SPERP”).

Therefore, the required use cases and Purchasing Document combinations need to be assessed well within the project. And afterwards, it is very important for the business end users to ensure that the Purchase Orders are setup correctly, otherwise the deferrals calculation would be wrong. This should be tested and then checked regularly in the beginning of the usage of deferrals calculations.

Processing Steps:

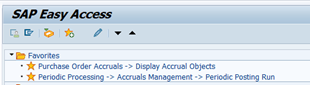

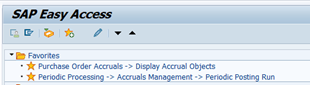

Once this initial setup is done, you can run following transaction to test and verify your deferral calculations:

Figure 7: Transactions to run the Accruals Management

As a result, and if everything is setup correctly, you will find the deferrals are posted automatically and correctly.

No comments:

Post a Comment