Introduction

With S/4HANA 1909, accrual engine has introduced “Review and Approve accruals” transactions.

There are additional transactions introduced are as follows:

1. ACEPROPOSALRUN – Propose Periodic Amounts

2. FACRATIVL – Edit Time Intervals for Accruals Reviews and Approvals

3. FACRARVWCO – Review Periodic Accruals – Controllers

4. FACRAAPPRVGL – Approve Periodic Accruals – G/L Accountants

The process is driven by Standard accrual periodic flow wherein accrual object is created by preparer, reviewed by reviewer, approved by approver and then it is can be posted manually or by scheduling batch jobs.

In this blog, I would explore customising the periodic accrual – ACCRL_PER in manual accrual flow so that reviewer and approver concept is displayed. This will involve right from creating the accrual object, one with value lower than the threshold limit and other with value more than the threshold limit description the process in details.

Please note:

◉ The configurations described below are relevant for SAP S/4HANA 1909.

◉ No coding is required to set up this flow, so this can be done without any development or ABAP knowledge.

Business Requirement

For the purpose of this blog, we would explore the requirements as follows:

◉ Requirement that a low value transaction of less than USD 100 is not required to be reviewed or approved.

◉ Reviewer and approver shall be different person with different authorisation.

Configuration Details

Steps to set up the periodic accrual engine flow

Step 1. Assign company code to the S4 HANA accrual engine

◉ Assign the company code for which accrual engine must be activated

Step 2. Close fiscal year for changes to Accrual objects

◉ Mention the year for which accrual objects is not required to be change.

Step 3. Accrual Method

◉ Define the different accrual method for accrual calculations along with the ABAP class so that the system calculates the accrual value due for the period or date.

◉ LINEAR accrual method with ABAP class “CL_ACE_CFG_METHOD_LINEAR_P1” for period posting. Likewise, different standard ABAP class are to be selected and defined against each of the method.

◉ New accrual method can be defined here other than standard through enhancements.

Step 4. Define reasons why adjusting periodic amount in review and approval of accruals

◉ Reviewer has the authorisation to change the accrual amount on review due date or due period.

◉ Define the possible reasons for change in the accrual value which will be used by the reviewer when any accrual due amount is changed to tag the reason for change against each change.

◉ The comment may be made mandatory.

Step 5. Define threshold variants for review and approval of accruals

◉ Define threshold limit against each currency under different threshold variant.

◉ Define lower threshold and upper threshold amount along with currency for which no reviewer or approver is required in the system.

◉ If the accrual amount in a given period is below the lower threshold, the accrual amount will not be approved automatically by the system, and the Approval Required checkbox on the Review and Approve Accruals screens will be read-only, that is, no user will be able to approve this amount. In this case, the Accrual Engine won’t post the accrual amount.

◉ If the accrual amount in a given period exceeds the lower threshold, but is below the upper threshold, the accrual amount is automatically approved by the system on the screens for reviewing and approving accruals. The system also automatically approves accrual amounts equal to the lower threshold.

◉ If you don’t want the system to approve accrual amounts automatically, you can enter the same amount for both the upper and lower threshold amounts. This prevents the system from approving accruals automatically and makes it necessary to approve them manually.

◉ Default variant can also be selected from the defined list of thresholds.

Step 6. Define Time interval

◉ Define time interval variants for reviewing and approving.

◉ Give the description for different variant saved in the system.

◉ Default variant can be selected from the defined list of threshold limit against each currency under different threshold variant.

◉ Select the variant and save the time intervals for review and approval.

◉ List the last day of period along with the following details:

◉ Review start date

◉ Review start time

◉ Review end date

◉ Review end time

◉ Approval start date

◉ Approval start time

◉ Approval end date

◉ Approval end time

Step 7. Define accrual item type

◉ Define the standard periodic accrual type with the accrual method defined.

◉ Linear method will enable the system to calculate the accrual value each period or date as per configuration depending on the life of the accrual object.

◉ It can be defined as upload allowed, if accrual objects are created through excel upload.

Step 8. Item type settings for ledger group

◉ Define the frequency of standard periodic accrual type.

◉ Define the reversal posting type for standard accrual type.

◉ Specify the ledger for accrual posting.

◉ Define settings for review and approval

◉ Select the variant which was defined for review and approval.

Step 9. Define Posting schema

◉ Define which line items a posting can contain represented by a symbolic account.

◉ Define the posting schema and give a description to it.

◉ Appropriate account is derived from the symbolic account by using the account determination.

◉ Define the symbolic account for periodic accruals.

◉ Define the standard SLA line item type against each symbolic account.

Step 10. Assignment of accrual item types to posting schemas

◉ Define journal entry type to be used in the accrual postings.

◉ Define posting schema for each accrual item type.

◉ Define document type for each of these accrual item types.

Step 11. Create basic account determination

◉ Account determination for accrual postings by entering at least the symbolic account and the G/L account to be used for accruals.

◉ Define G/L account to be used in the accrual postings.

Step 12. Define accrual object categories

◉ Define object category to group together accrual objects of a similar nature.

◉ Object category like salary, legal expenses, etc can be created.

Step 13. Assign parameters to Accrual object categories

Any field which is required to be incorporated in accrual can be defined here as a parameter.

Step 14. Define number range for accrual object

◉ Number range may be internal or external to be defined at company code level.

◉ In case of external number range, we need to give the accrual object while creating the same.

Step 15. Assign number range to object categories

◉ Assign the defined number range to object categories created.

◉ Different defined number ranges can be assigned to different object categories.

Periodic Accrual Process Flow

The following flowchart describes the Periodic accrual accounting process via accrual engine (example).

The above diagram explains step by step periodic accrual process using accrual engine. Please note that this is the standard step by step SAP flow. This flow may be modified as per client requirement and through various enhancements.

Step 1: Create accrual object

Transaction: ACACTREE01

Enter

Click on download excel template

Click on option 1 for periodic accruals and save it in your system.

Fill in the excel template.

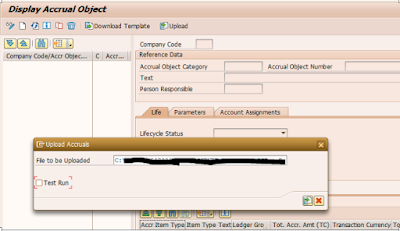

Step 2: Upload the excel template

Transaction: ACACTREE01

Navigation

Attach the file form the system

Execute the process in test run

◉ Since no errors were encountered, it will be uploaded in actual run by unticking the test run option.

Execute

Two accrual objects got created with number 12 and 13 amounting to 90000 USD and 45 USD respectively.

Step 3: Propose periodic run

Transaction: ACEPROPOSALRUN

Navigation

Enter the parameters

◉ Company code: 0001

◉ Accrual item type: ZSALARY

◉ Last day of period: 30.04.2020

◉ Accrual object: ZSALARY 12 and 13

Tick test run to check for any error

◉ Execute in test run mode to check for any errors.

◉ Since no errors are encountered, it will be executed in actual run

Execute

Within threshold limit?

◉ Two columns which are highlighted are review status and review type.

Review status details

◉ Review status as X – reviewed for accrual object 12 is because the accrual value is more than threshold limit.

◉ Review status as U – not applicable for accrual object 13 is because the accrual value is less than the lower threshold limit of 100 USD.

Review type details

◉ Review type as E- Explicit review is required as accrual value is more than the upper threshold limit of 1000 USD.

◉ Review type as B – No review required as accrual value is less than the lower threshold limit if 100 USD.

Since, two accrual object is created, accrual object number 12 will follow step 5 and 6 but, accrual object number 13, accrual engine will not post any document as it is below threshold limit.

Step 4: Edit time interval for review and approval

Transaction: FACRATIVL

Navigation

Enter

◉ Select the variant

◉ Below intervals are defined in the variant.

◉ It can be changed on requirement or any other reason like management decision or change in timelines, etc.

◉ Edit the time interval for 30.04.2020 as we want to review and approve on 02.04.2020, though ideally it should be in month of may.

Changed value for April 20

◉ Time can also be set here depending on the country time zone.

Step 5: Review Periodic accruals

Transaction: FACRARVWCO

Navigation

Enter the parameters

◉ Company code: 0001

◉ Accrual type: ACCRL_PER

◉ Accrual Object: ZSALARY 0000000000000000000012

◉ Last Day of period: 30.04.2020

Execute

Accrual Value of 10000 USD can be changed by the reviewer, select the adjustment reason for the same and comment on the same.

◉ Changing the accrual value from 10000 USD to 11000 USD.

◉ Tick the amount review tab and click on set as reviewed tab

◉ Save the screen to complete the review.

Step 6: Approve Periodic accruals

Transaction: FACRAAPPRGL

Navigation

Enter the parameter:

◉ Company code: 0001

◉ Accrual item type: ACCRL_PER

◉ Accrual Object: ZSALARY 0000000000000000000012

◉ Last Day of period: 30.04.2020

Execute

◉ Both the accrual value is displayed, proposed and reviewed accrual value.

◉ Adjustment reason and comment is also displayed to the approver given by reviewer.

◉ Tick on amount approver and click on approve tab.

◉ Save the screen changes.

Step 7: Periodic posting run

Transaction: ACEPOSTINGRUN

Navigation

Enter the parameter:

◉ Company code:0001

◉ Accrual Type: ACCRL_PER.

◉ Last day of period: 30.04.2020

◉ Accrual Object: ZSALARY 0000000000000000000012

◉ Execution in test run to check for errors.

Execute

◉ No error encountered.

Execute

Step 8: Reverse Periodic posting

Transaction: ACACTREE02

Navigation

Enter the parameter:

◉ Company code: 0001

◉ Accrual object Category: ZSALARY

◉ Accrual Object Number : 12

Execute

◉ Click on Postings tab

◉ Accrual entry posted by the system – document number 100000015.

◉ Select the line item to be reversed and click on reverse tab.

◉ Enter the date manually on which date it is to be reversed.

Enter

◉ Reversal document posted by the system.

No comments:

Post a Comment